➡ Click here: File tax extension 2018

Before you efile, know the tax amount you owe. The reason is simple: OVDP is a voluntary program and if you are only entering because you are already under IRS examination, then technically, you are not voluntarily entering the program — rather, you are doing so under duress.

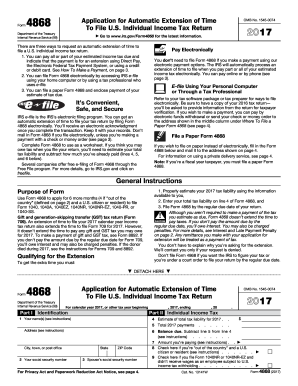

Someone who is living outside the country and whose main place of business is also outside the country has an automatic two-month extension for filing. Any taxpayer can get an tout 6-month tax return extension by efiling the IRS Form 4868. If you were out of the country, you are automatically allowed a two-month filing extension, until June 15, but you still must pay interest on any taxes due starting File tax extension 2018 17. If you need an extension on your glad tax return, for filing requirements and due dates. We represent Attorneys, CPAs, Doctors, Investors, Engineers, Business Owners, Entrepreneurs, Professors, Athletes, Actors, Entry-Level staff, Students, and more. You can pay with your credit card online or by phone.

If you use the U. That's a backup method that can come in handy in a pinch. Approximately 10 million U. IRS tax extension are emails directly to the IRS for acceptance.

How to File a Federal, IRS Tax Return Extension Form 4868 - Special discount offers may not be valid for mobile in-app purchases. Scripts to automatically harvest results are strictly prohibited due to performance reasons and will result in your IP being banned from this website.

The FBAR is the Report of Foreign Bank and Financial Account Form. It used to be due on June 30th, but recently was changed to April…and it is on automatic extension through October 2018. FBAR Recently, we had a client contact us in hysterics. He told her she needed to pay him money ASAP in order to file the FBAR by April 15, 2018. This was despite the fact that she already applied for an extension to file her tax returns. FBAR is on Automatic Extension We guess even Offshore Disclosure Leaders are not keeping up with current tax law. Automatic Extension of the FinCEN 114 FBAR Recently, in February of 2018, FinCEN issued a notice that the FBAR is on Automatic Extension. Filers who fail to file their 2017 calendar year FBAR by April 17, 2018, have an automatic extension up to October 15, 2018 What is the FBAR? FBAR is the Report of Foreign bank and Financial Account form. It is one of the most common IRS international tax forms, because it has a relatively low threshold requirement, and is a very broad form, encompassing many different types of foreign accounts. Important FBAR Definitions Foreign Outside of the United States. No same-country exception for reporting. Reporting Means the filing of the FBAR form, online on the FinCEN website. FBAR Report of Foreign Bank and Financial Account Form. FinCEN Form 114 FinCEN is a financial crimes enforcement network. FinCEN created the form initially back in the 1970s, but now the IRS enforces penalties. BSA The Bank Secrecy Act How to File The Form While we always recommend using a tax professional when submitting forms to the IRS, we understand many of you want to do it yourself. This guide is intended to provide you the basics of reporting. It is not intended for you to rely or your tax professional in actually filing the form. The summary is basic, and there are many other factors that may impact your specific filing, especially if it is a late filing. Step 1 — Are you a U. The form must be filed by U. In order to confuse you, the IRS does not define US person to mean the same as U. A US person typically falls into three categories: U. Citizen, Legal Permanent Resident, Foreign National who meets the IRS Substantial Presence Test typically individuals on H-1B Visa, L-1 Visas, and E-2 Visas — although it is not a requirement to have one of these Visas. If you are a US person, then you move on to step two. Step 2 — Do You Meet the Threshold Requirements? The threshold requirements are relatively simple. On any day of the year, if you aggregated totaled the maximum balances of all of your foreign accounts, does that total amount exceed 10,000? If it does, then you have to file the form. Step 3 — Identify What is an Account This is one of the more difficult parts of the job. Therefore, many people understandably so will only focus just on bank accounts. Unfortunately, you have to include all financial accounts unless it is otherwise excluded and there are only a few exclusions. This is an important question, because if you have more than 25 accounts then you do not have to list all of the accounts on the actual form. Rather, you maintain your own records so that the IRS contacts you on a future date, you will have that information available. Like most people, if you have less than 25 accounts then you would report all the accounts on the FBAR. Step 5 — What is Your relationship to the Account? There are different sections of the FBAR. The latter category typically includes people who may have been included on the account in emergency when a parent or elderly individual is getting on age. Also, if you are an employee and you have signature authority, that is included as well. Step 6 — Categorize the Different Accounts It is important that you prepare separate categories to identify each different type of account. That is to make sure that, for example, you do not report an account you have signature authority in this section that is labeled account ownership, because then the IRS and U. Step 7 — Determine the Maximum Balance You are not required to search for the holy Grail of maximum balances. In other words, you should do the best you can. If you have bank statements for each month, then you would use each month statement to determine what the maximum value is. Likewise, if you have a passport account passbook account and you only get it updated when you enter the bank, then you will have to use the best value you can. Thereafter, make sure you have identified the maximum balance available for each account. Step 8 — Use the Exchange Rate You are not required to use any specific exchange rate, but it has to be reasonable. Both the Department of Treasury and the IRS each publish their own annual exchange rates and feasibly, either exchange-rate would be okay to use. It is important to make sure that you use the respective exchange rate for the year at issue. Sorry for those of you with euros, rupees or rubles who want to use current exchange rates for prior years. Step 9 — Complete the FBAR The FBAR is a relatively simple from a preparation standpoint. In other words, for each account, you will identify the name of the institution, the address and the maximum balance. If you are unable to access the maximum balance or even come up with your best estimate, you can mark off maximum balance unknown for each account of which this is applicable. If you are in this type of situation, please be sure to speak with an experienced Offshore Disclosure Lawyer first. Filing a late FBAR outside of the offshore disclosure programs is typically considered a Quiet Disclosure and can land you in some real trouble. If you happen to have zero unreported income that means zero unreported income from abroad and not zero tax liability you may be able to qualify for the delinquency procedures, which results in a penalty waiver and a relatively simple submission procedure. If you have any unreported income, you can still make a reasonable cause submission but it is different. Most individuals prefer to enter one of the approved programs such as streamlined filing compliance procedures or traditional OVDP — you may have multiple options available to you. We do not recommend making any submission to the Internal Revenue Service regarding any foreign or offshore accounts without at least speaking with an experienced offshore disclosure lawyer first to evaluate and assess your facts. Whether it is a simple or complex case, safely getting clients into compliance is our passion, and we take it very seriously. Unlike other attorneys who call themselves specialists but handle 10 different areas of tax law, purchase multiple domain names, and even practice outside of tax, we are absolutely dedicated to Offshore Voluntary Disclosure. No Case is Too Big; No Case is Too Small. We represent all different types of clients. We represent Attorneys, CPAs, Doctors, Investors, Engineers, Business Owners, Entrepreneurs, Professors, Athletes, Actors, Entry-Level staff, Students, and more. You are not alone, and you are not the only one to find themselves in this situation. Golding, JD, LLM, EA is the only Attorney nationwide who has earned the Certified Tax Law Specialist credential and specializes in IRS Offshore Voluntary Disclosure and closely related matters. In addition to earning the Certified Tax Law Certification, Sean also holds an LL. He is frequently called upon to lecture and write on issues involving IRS Offshore Voluntary Disclosure. The exam is widely regarded as one of if not the hardest tax exam given in the United States for practicing Attorneys. It is a designation earned by less than 1% of attorneys. Our International Tax Lawyers represent hundreds of taxpayers annually in over 60 countries. There are many aspects that go into any particular tax calculation, including the legal status, marital status, business status and residence status of the taxpayer. When Do I Need to Use Voluntary Disclosure? Voluntary Disclosure is for individuals, estates, and businesses who are out of compliance with the IRS and the Department of Treasury. What does that mean? It means that for one or more years, you were required to file a U. To combat this, you can take the proactive approach and submit to IRS Offshore Voluntary Disclosure. In fact, any money that is outside of the United States is considered to be offshore; the term offshore is not a bad word. In other words, merely because a person has money offshore a. Many of our clients have assets and bank accounts in their homeland countries and these are considered offshore assets and offshore bank accounts. The Devil is in the Details… If you do have money offshore, then it is very important to ensure that the money has been properly reported to the U. In addition, it is also very important to ensure that if you are earning any foreign income from that offshore money, that the earnings are being reported on your U. It does not matter whether your money is in a country that does not tax a particular category of income for example, many Asian countries do not tax passive income. Rather, the default position is that if you are required to file a U. If you already paid foreign tax on the income, you may qualify for a Foreign Tax Credit. In addition, if the income is earned income — as opposed to passive income — and you meet either the Bona-Fide Resident Test or Physical-Presence Test, then you may qualify for an exclusion of that income; nevertheless, the money must be included on your tax return. What if You Never Report the Money? If you are in the unfortunate position of having foreign money or specified foreign assets that should have been reported to the U. As we have indicated numerous times on our website, there are very unscrupulous CPAs, Attorneys, Accountants, and Tax Representatives who would like nothing more than to get you to part with all of your money by scaring you into believing you are automatically going to be arrested, jailed, or deported because you have unreported money. While that is most likely not the case depending on the facts and circumstances of your specific situation , you may be subject to extremely high fines and penalties. Four of these methods are perfectly legitimate as long as you meet the requirements for the particular mechanism of disclosure. The fifth alternative, which is called a Quiet Disclosure a. Soft Disclosure, is ill-advised as it is illegal and very well may result in criminal prosecution. We have also included links to the specific programs. Unlike the technical jargon of the IRS FAQs, our FAQs are based on the hundreds of different types of issues we have handled over the many years that we have been practicing international tax law and offshore disclosure in particular. After reading this webpage, we hope you develop a basic understanding of each offshore disclosure alternative and how it may benefit you to get into compliance. We do not recommend attempting to disclose the information yourself as you may become subject to an IRS investigation insofar as you will have to answer questions directly to the IRS, which you can avoid with an attorney representative. If you retain an attorney, then you will get the benefit of the attorney-client privilege which provides confidentiality between you and your representative. With a CPA, there is a relatively small privilege which does provide some comfort, but the privilege is nowhere near as strong as the confidentiality privilege you enjoy with an attorney. Since you will be dealing with the Internal Revenue Service and they are not known to play nice or fair — it is in your best interest to obtain an experienced Offshore Disclosure Attorney. OVDP — a program designed to facilitate taxpayer compliance with IRS, DOT, and DOJ International Tax Reporting and Compliance. Government Laws and Regulations. The Offshore Voluntary Disclosure Program is open to any US taxpayer who has offshore and foreign accounts and has not reported the financial information to the Internal Revenue Service restrictions apply. The reason is simple: OVDP is a voluntary program and if you are only entering because you are already under IRS examination, then technically, you are not voluntarily entering the program — rather, you are doing so under duress. Any account that would have to be included on either the as well as additional income generating assets such as rental properties are accounts that qualify under OVDP. It should be noted that the requirements are different for the modified streamlined program, in which the taxpayer penalties are limited to only assets that are actually listed on either an FBAR or 8938 form; thus the value of a rental property would not be calculated into the penalty amount in a streamlined application, but it would be applicable in an OVDP submission. An OVDP submission involves the failure of a taxpayer s to report foreign and overseas accounts such as: Foreign Bank Accounts, Foreign Financial Accounts, Foreign Retirement Accounts, Foreign Trading Accounts, Foreign Insurance, and Foreign Income, including 8938s, FBAR, Schedule B, 5741, 3520, and more. What is Included in the Full OVDP Submission? Under this program, the Internal Revenue Service wants to know all of the income that was generated under these accounts that were not properly reported previously. The way the taxpayer accomplishes this is by amending tax returns for eight years. OVDP Penalties The taxpayer is required to pay the outstanding tax liability for the eight years within the disclosure period — as well as payment of interest along with another 20% penalty on that amount for nonpayment of tax. This must be done for each year during the compliance period. The Penalty is 27. To determine what the maximum value is, the taxpayer will add up the highest balances of all of their accounts for each year. In other words, for each tax year within the compliance period, the application will locate the highest balance for each account for each year, and total up the values to determine the maximum value for each year. Streamlined Domestic Offshore Disclosure The is a highly cost-effective method of quickly getting you into IRS Internal Revenue Service or DOT Department of Treasury compliance. What am I supposed to Report? There are three main reporting aspects: 1 foreign account s , 2 certain specified assets, and 3 foreign money. While the IRS or DOJ will most likely not be kicking in your door and arresting you on the spot for failing to report, there are significantly high penalties associated with failing to comply. If you are determined to be willful, the penalties can reach 100% value of the foreign accounts, including many other fines and penalties… not the least being a criminal investigation. Reporting Specified Foreign Assets — FATCA Form 8938 Not all foreign assets must be reported. With that said, a majority of assets do have to be reported on a form 8938. For example, if you have ownership of a foreign business interest or investment such as a limited liability share of a foreign corporation, it may not need to be reported on the FBAR but may need to be disclosed on an 8938. The reason why you may get caught in the middle of whether it must be filed or not is due largely to the reporting thresholds of the 8938. Other Forms — Foreign Business While the FBAR and Form 8938 are the two most common forms, please keep in mind that there are many other forms that may need to be filed based on your specific facts and circumstances. It does not matter if you earned the money in a foreign country or if it is the type of income that is not taxed in the country of origin such as interest income in Asian countries. The fact of the matter is you are required to report this information on your US tax return and pay any differential in tax that might be due. If you have to pay the exact same in the United States as you did in Japan, it would equal itself out. If you would owe more money in the United States than you paid in Japan on the earnings a. If you live overseas and qualify as a foreign resident reside outside of the United States for at least 330 days in any one of the last three tax years or do not meet the Substantial Presence Test , you may be in for a pleasant surprise. Even though you may be completely out of US tax and reporting compliance, you may qualify for a penalty waiver and ALL of your disclosure penalties would be waived. Thus, all you will have to do besides reporting and disclosing the information is pay any outstanding tax liability and interest, if any is due. Your foreign tax credit may offset any US taxes and you may end up with zero penalty and zero tax liability. Reasonable Cause Reasonable Cause is different than the above referenced programs. Contact us Today, Let us Help. We took over for another firm that was inexperienced in OVDP and got the clients into a major jam and reduced the OVDP penalty to only a fraction of the original penalty, which was LOWER than the Streamlined Penalty would have been. We were able to work with the IRS and client was approved for Streamlined Filing Compliance Procedures. Based on their specific facts and circumstances, we were able to submit them using the Reasonable Cause option. United States Tax Lawyers: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming. International Tax Lawyers: Afghanistan, Argentina, Australia, Austria, Bermuda, Brazil, British Virgin Islands, Bulgaria, Canada, Cayman Islands, China, Costa Rica, Germany, Hong Kong, India, Indonesia, Iraq, Israel, Italy, Japan, Jersey Islands, Korea, Malaysia, Malta, Mexico, Morocco, New Zealand, Nicaragua, Pakistan, Philippines, Singapore, Switzerland, South Africa, Thailand, Taiwan, and Turkey, and more! © 2017 - LawDog Enterprises - All Rights Reserved - No Legal Advice Intended: This website includes information about legal issues and legal developments. Such materials are for informational purposes only and may not reflect the most current legal developments. These informational materials are not intended, and should not be taken, as legal advice on any particular set of facts or circumstances. You should contact an attorney to discuss your specific facts and circumstances and to obtain advice on specific legal problems.